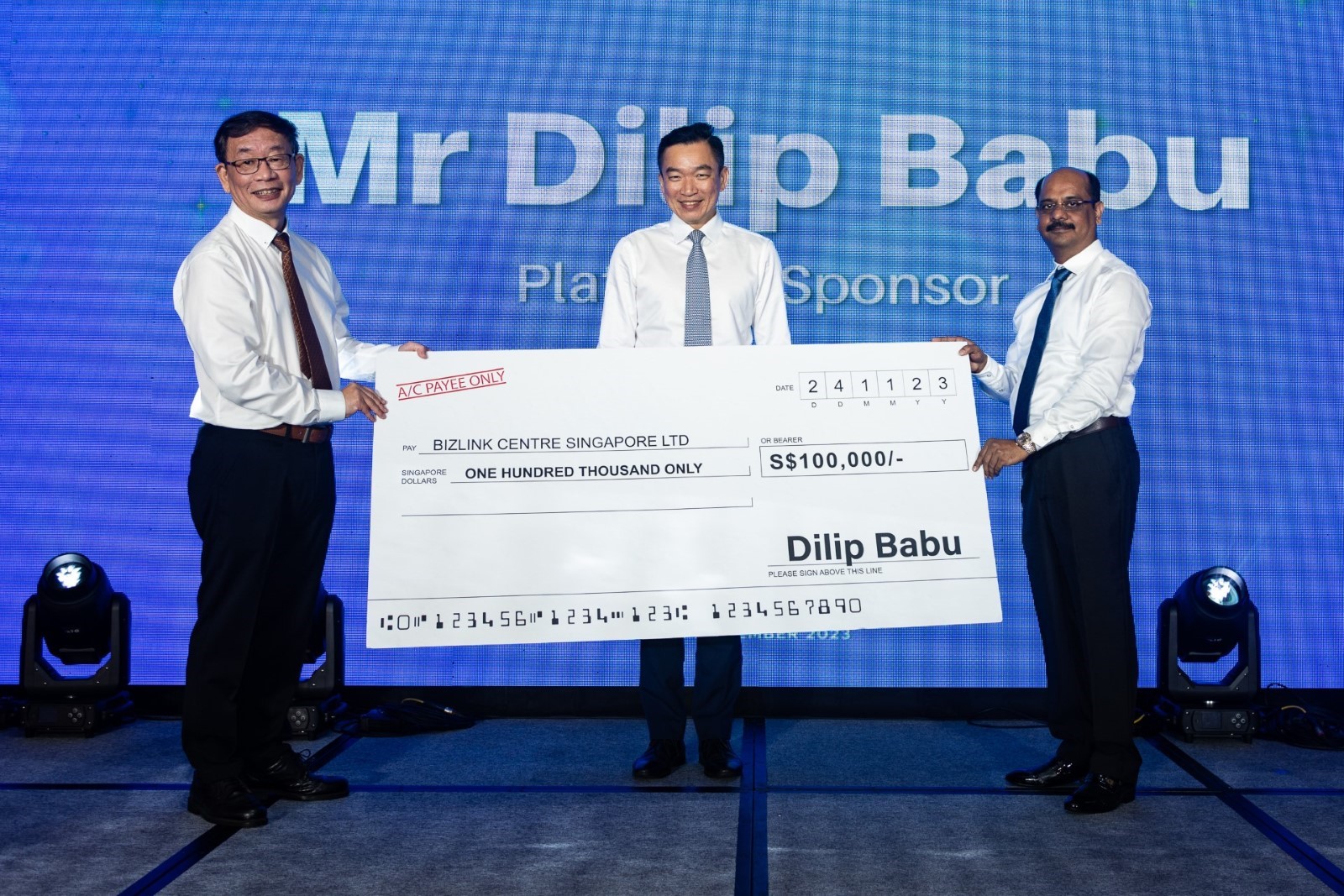

CEO of Info-Tech and Jobs Lah Donates $100,000 at Bizlink Centre’s Enabling Employment Charity Dinner

SINGAPORE – 24 November 2023 – Mr Dilip Babu, CEO of Info-Tech Systems Integrators,

) Explore

more

Explore

more

An all-in-one solution, a complete 360° HR software to help you manage HR matters in the office or on-the-go.

SINGAPORE – 24 November 2023 – Mr Dilip Babu, CEO of Info-Tech Systems Integrators,

) Explore

more

Explore

more

SINGAPORE – November 24, 2023 – Info-Tech Systems Integrators, an industry leader in

) Explore

more

Explore

more

Info-tech Systems Integrators, a leading cloud-based HR and accounting software provider

) Explore

more

Explore

more

Info-Tech is an award-winning leading provider of Human Resource Management System (HRMS) and Accounting Software. Our software is designed to streamline your HR and Accounting operations, offering a complete package to meet all your needs.

Our HRMS software offers comprehensive modules encompassing various features such as time attendance tracking, leave and claim management, appraisal, mobile attendance, payroll, and more.

Our Accounting software enables you to handle all accounting tasks, including creating and delivering invoices, profit analysis, bank reconciliation, etc., easily, and more quickly!

With Info-Tech’s HRMS and Accounting software, you can enjoy a wide range of benefits, including:

Cost-Effectiveness

Access top features and modules at an affordable pricing.

Enhanced Data Security

Experience top-notch data security in the cloud for your peace of mind.

All-In-One Solution

Perform all HR and Accounting tasks seamlessly on a single platform.

24/7 Accessibility

Conveniently access the system from anywhere at any time.

Yes, Info-Tech Accounting Software is IRAS-approved and GST-compliant.

During the implementation stage, our Implementation Specialist will configure the system according to your company's requirements. Subsequently, our trainers will conduct virtual training sessions to guide you on utilising the software effectively. Once the system is live, you will be assigned a dedicated Software Support Specialist who will be available to address any inquiries or issues that may arise.

You can reach us at +65 6297 3398 or sales@info-tech.com.sg, and our sales team will assist you with the next steps.

Here are some recent accolades & recognitions we have received, highlighting

our achievements as the

leading HR and Accounting software provider.